Understand rental properties vs resale investments and make smarter real estate choices to build wealth, brick by brick.BLOG

Introduction

Real estate has always been considered one of the most trusted wealth-building tools. But when it comes to actually investing your hard-earned money, one question often creates confusion:

Should you invest in rental properties or resale properties?

This single decision can shape your financial future. Whether you’re a first-time investor or looking to expand your portfolio, understanding rental properties vs resale is the key to making smarter real estate decisions.

In this blog, we will compare both investment options in a simple, human way—no jargon, no confusing formulas—just practical insights that help you build wealth brick by brick.

What Are Rental Properties?

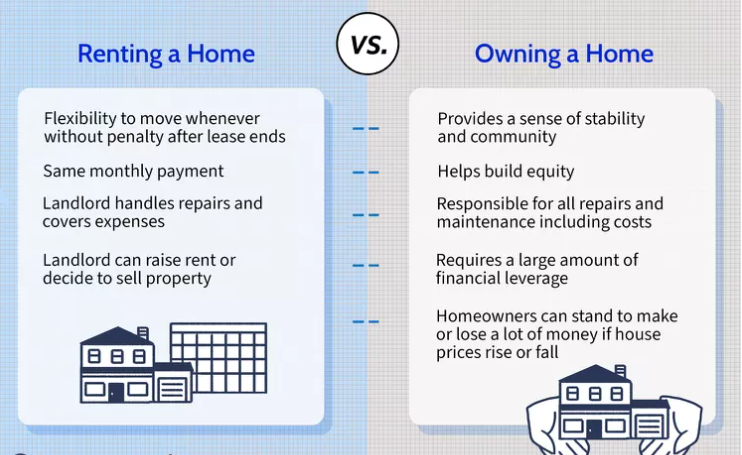

Rental properties are real estate assets purchased with the intention of earning steady monthly income through tenants. You don’t buy them to sell later—you buy them to generate rental cash flow.

Why Investors Love Rental Properties

- Steady income every month

- Long-term asset appreciation

- Tax benefits in many regions

- Suitable for passive income seekers

- Real estate value typically increases with time

What Is a Resale Property?

A resale property is a home or commercial space bought with the intention of selling later at a higher price. The goal is capital gain, not monthly income.

Why Investors Prefer Resale

- High profits if bought at the right time

- Faster returns compared to rentals

- Good for people who understand market trends

- Works well when the real estate market is booming

Rental Properties vs Resale — The Core Difference

| Factor | Rental Properties | Resale Properties |

|---|---|---|

| Income Type | Monthly cash flow | One-time profit |

| Investment Duration | Long-term | Short to medium term |

| Risk Level | Low to moderate | Depends on market condition |

| Ideal For | Passive income seekers | Investors with market knowledge |

| Tax Benefits | Often available | Limited in most cases |

Which Option Builds Wealth Faster – Rental or Resale?

.In rental properties vs resale, rentals are better for long-term wealth—steady income and rising value. Resale gives faster profits but depends on market timing.

Think of it like this:

- Rental = Slow and steady growth

- Resale = Quick but uncertain

Therefore, the answer depends on your risk-taking ability and financial goals.

Pros & Cons of Rental Properties

Advantages of Rental Properties

✔ Monthly income

✔ Lower risk

✔ Appreciation value over years

✔ Suitable for retirement planning

✔ Helps you build wealth brick by brick

Disadvantages of Rental Properties

✘ Requires tenant management

✘ Maintenance costs

✘ Long-term commitment

Pros & Cons of Resale Properties

Advantages of Resale Investments

✔ Faster profit

✔ No need to manage tenants

✔ Good for market-savvy investors

✔ Can multiply capital in a short time

Disadvantages

✘ High risk during market slowdown

✘ No monthly income

✘ Requires correct timing to sell

✘ Legal paperwork and brokerage cost

Rental Properties vs Resale – Which Is Safer?

If your priority is security, rental properties clearly offer better safety. Because even if property prices fall, your rental income continues. But in resale, everything depends on market timing. If the market is down, your profit disappears.

So, for risk-free investment → rental properties are better.

Which Option Gives Better Returns?

Rental Return Example:

- Property Price: ₹50 Lakhs

- Monthly Rent: ₹20,000

- Annual Rent: ₹2.4 Lakhs

- ROI = 4.8% per year (plus appreciation)

Resale Return Example:

- Buy Property for ₹50 Lakhs

- Sell After 3 Years for ₹60 Lakhs

- Profit: ₹10 Lakhs

- ROI = 20% (but only once)

Conclusion:

Resale gives higher return in less time—but only if the market is booming. Rental gives consistent income even in a slow market.

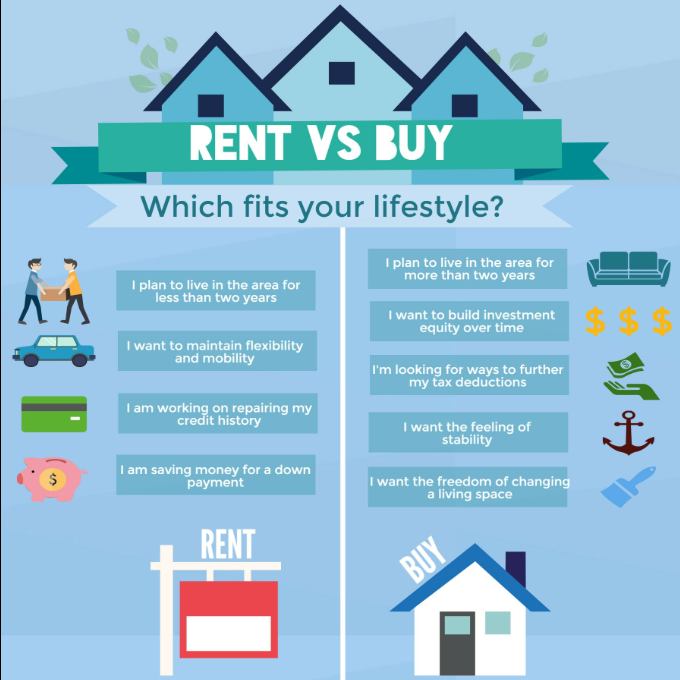

Who Should Invest in Rental Properties?

Ideal for:

- Salaried professionals

- First-time investors

- People seeking monthly income

- Long-term wealth builders

- Retirement planners

If your aim is to build wealth brick by brick, rental properties fit perfectly.

Who Should Invest in Resale?

Ideal for:

- Experienced investors

- People who understand property trends

- Those willing to take moderate risk

- Investors who want faster returns

- People with market connections

Location Matters – A Lot

Whether you choose rental properties vs resale, one factor remains the king of real estate—location.

Best Locations for Rentals

- College areas

- Business hubs

- IT parks

- Tourist locations

- Growing suburbs

Best Locations for Resale

- Upcoming residential projects

- Areas with government development plans

- Neighbourhoods near new highways, metros, or airports

How to Decide – Rental Properties vs Resale?

Ask yourself these questions:

- Do I need monthly income or lump sum profit?

- Can I wait 5+ years, or do I want results in 2–3 years?

- Do I understand real estate market cycles?

- Am I okay with tenant management?

- What is my risk tolerance?

Your answers will tell you where you should invest.

Smart Strategy – Mix Both!

A truly strong portfolio combines both rental and resale.

- One property for steady rentals

- Another for resale during a boom

This provides safety + growth, helping you build wealth brick by brick.

Final Verdict: Rental Properties vs Resale – Where Should YOU Invest?

| Goal | Best Option |

|---|---|

| Monthly Income | Rental Properties |

| Quick Profit | Resale |

| Low Risk | Rental Properties |

| High Return | Resale (if timing is right) |

| Retirement Planning | Rental Properties |

| Experienced Investor | Resale |

| Beginner | Rental Properties |

Conclusion – Build Wealth Brick by Brick

Real estate is not just about buying property—it’s about making your money work for you. Whether it’s rental properties vs resale, the right choice depends on your goals, timeline, and attitude towards risk.

But one thing is clear—real estate remains one of the most powerful ways to build wealth brick by brick. The key is to start early, , think smart, and invest wisely.